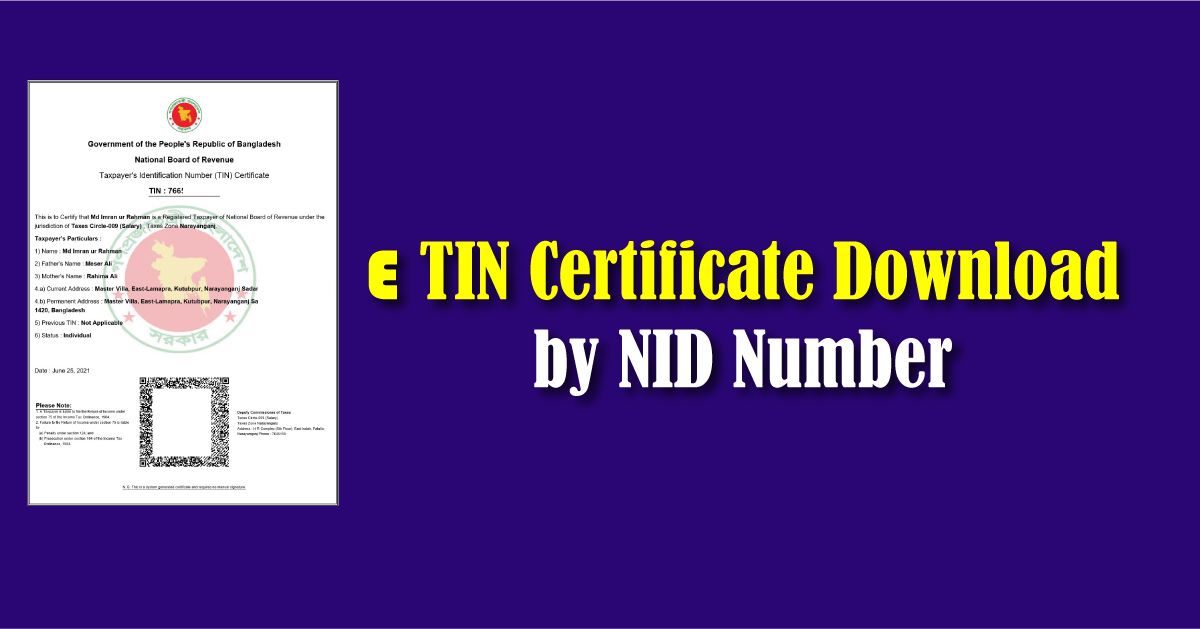

Governments globally are working to improve citizen services and streamline administrative procedures in an increasingly digital world. One such initiative is the introduction of E-TIN certificates, which facilitate and increase taxpayer accessibility to the tax registration process. This article explores the way to E TIN certificate download by NID number.

What is E Tin Certificate

E Tin Certificate stands for Electronic Taxpayer Identification Number Certificate. It is a digital document issued by the tax authorities in many countries to individuals and businesses for taxation purposes. This digital certificate serves as an identity proof, specifically for tax-related transactions.

E TIN Certificate, specifically in the context of Bangladesh, refers to an Electronic Tax Identification Number Certificate. This certificate is issued by the National Board of Revenue (NBR) in Bangladesh and serves as an electronic version of the traditional Tax Identification Number (TIN) certificate.

The primary purpose of an E Tin Certificate is to ensure a streamlined, efficient, and secure tax system. It facilitates online tax-related processes, including filing tax returns, paying taxes, and other transactional activities. The E Tin Certificate also helps in curtailing tax evasion, as it ensures that every taxpayer has a unique identification number for accurate tracking and reporting.

If you don’t have NID then cheek from here: NID Card Check Online Bangladesh (ভোটার আইডি / জাতীয় পরিচয় পত্র অনুসন্ধান)Why You Need E-TIN Certificate?

In Bangladesh, having an Electronic Tax Identification Number (E TIN) certificate is essential for various reasons:

- Legal Requirement: It is a legal requirement for individuals and businesses to obtain a TIN in Bangladesh. The E TIN is a unique identification number issued by the National Board of Revenue (NBR) for tax purposes. Failing to obtain a TIN may lead to legal consequences.

- Tax Compliance: The E TIN certificate is necessary for tax compliance. It is used to track and monitor an individual’s or business’s tax-related activities. This includes filing income tax returns, paying taxes, and engaging in other tax-related transactions.

- Financial Transactions: Having an E TIN is often a prerequisite for various financial transactions, including opening a bank account, obtaining trade licenses, and participating in government tenders. It is a means of ensuring transparency in financial dealings.

- Government Services: The E TIN may be required when accessing certain government services or participating in government contracts. It serves as a unique identifier for individuals and businesses in their interactions with government authorities.

- International Transactions: In some cases, the E TIN may be required for international transactions and dealings. It can be used as a form of identification when engaging in cross-border business activities.

- Online Access: The digitized nature of the E TIN allows individuals and businesses to manage their tax-related information online. This includes accessing and updating personal details, checking tax liabilities, and submitting tax returns electronically.

Overall, the E TIN certificate is a crucial document that ensures individuals and businesses comply with tax regulations, facilitates financial transactions, and streamlines interactions with government authorities in Bangladesh.

E TIN Certificate Download by NID Number

You cannot directly download a TIN Certificate using your TIN number. Hence, using just your TIN number will not allow you to download your TIN certificate. In order to register for an e-TIN, you must have the mobile number.

E-TIN verifies that a person or business is registered with the tax system. It is an essential document needed for a number of financial transactions, such as opening bank accounts, bidding on contracts, and carrying out business operations. The name of the taxpayer, their tax identification number, and other pertinent information are all included in the E-TIN certificate.

In Bangladesh, the National Board of Revenue issues ETIN certificates.

In order to identify taxpayers, the ETIN certificate is necessary for a number of tax-related tasks, such as registering for VAT, submitting tax returns, and paying taxes.

For companies and individuals who must pay taxes in Bangladesh, having an ETIN certificate is crucial because it enables them to fulfill their tax obligations and stay out of trouble. Because it serves as a unique identification number to identify the taxpayer, it is connected to the NID number.

Disadvantages of Tin Certificate

E TIN Certificate Download by NID Number: Full Process

Now your doubts are going to be removed because here with few steps you are going to know how to download e tin certificate by NID number.

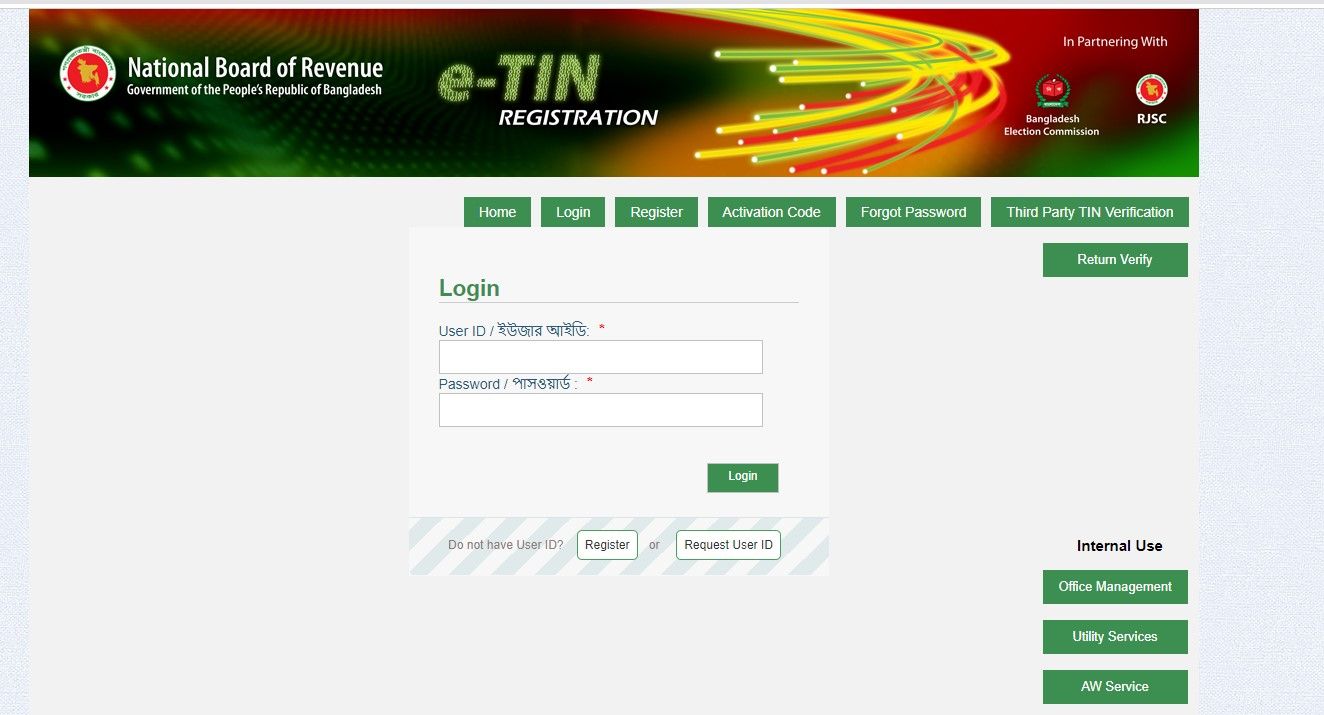

- Go to the tax authority’s official website, which handles E-TIN issuance.

- Using your NID number and other necessary information, create an account or log in.

- In accordance with the guidelines, provide accurate information and upload the required documents.

- The supporting documentation and information will be checked by the tax authority. This could entail using the NID number to cross-reference with government databases.

- Your application will be reviewed by the tax authority following a successful verification.

- Your application will be accepted and an E-TIN certificate will be issued if everything is in order.

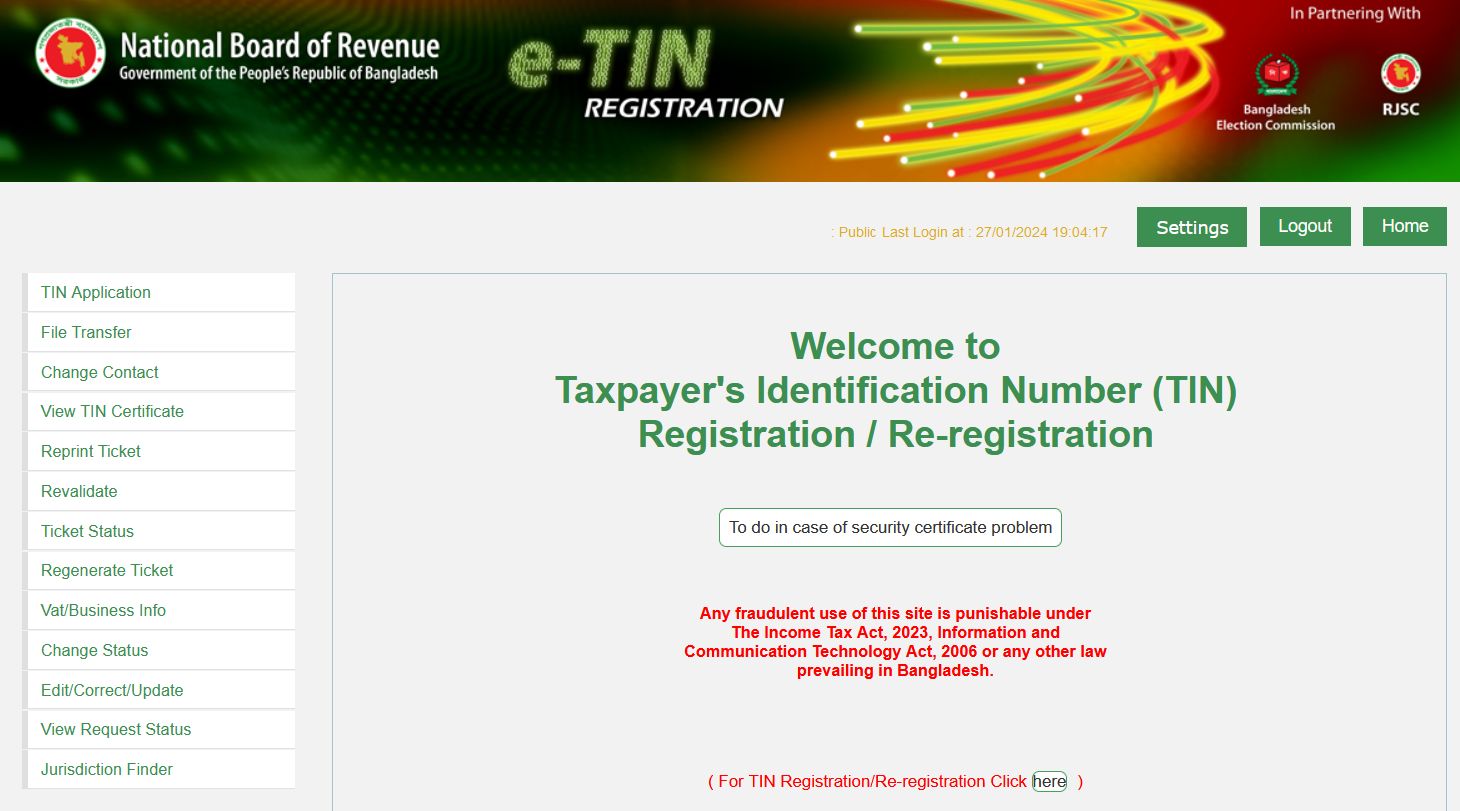

- Go to the tax authority’s website and log into your account.

- Navigate to the section for the E-TIN certificate.

- Enter the necessary information along with your NID number.

- Your E-TIN certificate will be generated and displayed by the system.

- Download the secure version of the E-TIN certificate.

- If needed, print the certificate for your physical records.

- Due to the fact that the E-TIN certificate is an essential document for financial transactions, store both the digital and physical copies securely.

How Can You Activate E TIN Certificate Download by NID Number?

Depending on the specific country, the procedures for creating an account and downloading a TIN certificate by NID number may differ, but they usually entail the following:

- Go to the National Board of Revenue (NBR) website or the comparable government agency.

- To create a new account, click the “Register” or “Sign Up” button.

- Please supply your contact details, NID number, and name.

- Register an account with a username and password.

- Utilizing a mix of letters and numbers will help to distinguish the username.

- To verify your mobile device, it will be provided with an activation code. With this, the account has to be enabled.

- Next, fill in the characters shown in the image’s captcha. As such, give accurate information in your letters of verification.

- Once the form has been successfully filled out, click the Register button.

- Click on the link that was sent to your email address to confirm it.

- Enter your password and username to access your account.

- Please supply any additional data that is needed, such as tax or business information.

- Click the “Download” or “Print” button to download or print your TIN certificate.

Why You Should Not Download E TIN Certificate by TIN Number?

Since ETIN certificates associated with NID numbers are linked to an individual’s identity, it could be challenging for businesses to change contractors or employees without rescinding and issuing the certificate.

Furthermore, if a person’s NID number is stolen or compromised, it may be used to obtain an ETIN certificate fraudulently. Moreover, acquiring an ETIN certificate could be a laborious procedure requiring a large volume of paperwork.

FAQs about E TIN Certificate

What Is An E Tin Certificate Used For?

An E Tin certificate is used for electronic filing of tax returns in Bangladesh. It is also required for company registration and other business transactions.

How To Obtain An E Tin Certificate?

To obtain an E Tin certificate, you need to apply online through the National Board of Revenue’s website. Complete the application with required personal and tax information.

What Are The Documents Required For E Tin Certificate Application?

Documents required for E Tin certificate application include national ID card or birth certificate, passport size photograph, and relevant business documents such as trade license or incorporation certificate.

Is An E Tin Certificate Necessary For All Individuals And Businesses?

Yes, an E Tin certificate is necessary for all individuals and businesses who are eligible to pay taxes in Bangladesh. It is a mandatory requirement for tax compliance.

How Long Does It Take To Receive An E Tin Certificate After Applying?

Once the online application is submitted, it usually takes around 7-10 working days to receive the E Tin certificate electronically via email.

Ending Thought

The use of NID numbers for accuracy and efficiency in the tax registration process is revolutionized by the introduction of E-TIN certificates. By streamlining the process of issuing tax identification documents digitally, this method encourages accuracy, transparency, and ease of verification.

Governments are creating a more user-friendly and efficient tax environment for businesses and individuals by enabling taxpayers to get their E-TIN certificates using their NID numbers. The combination of tax and identification systems is a big step toward a more effective and citizen-friendly government as technology develops.