The income tax return form is mostly an annual report of an individual or business. This form contains the wages, income, expenses, gains, profit, loss, etc., of an individual or an institution. In Bangladesh, everything related to income tax is managed by the National Board of Revenue or NBR. They have launched the income tax return form for the taxpayers. Today, we will discuss all the details of the 1 Page Income Tax Return Form BD.

1 Page Income Tax Return Form BD

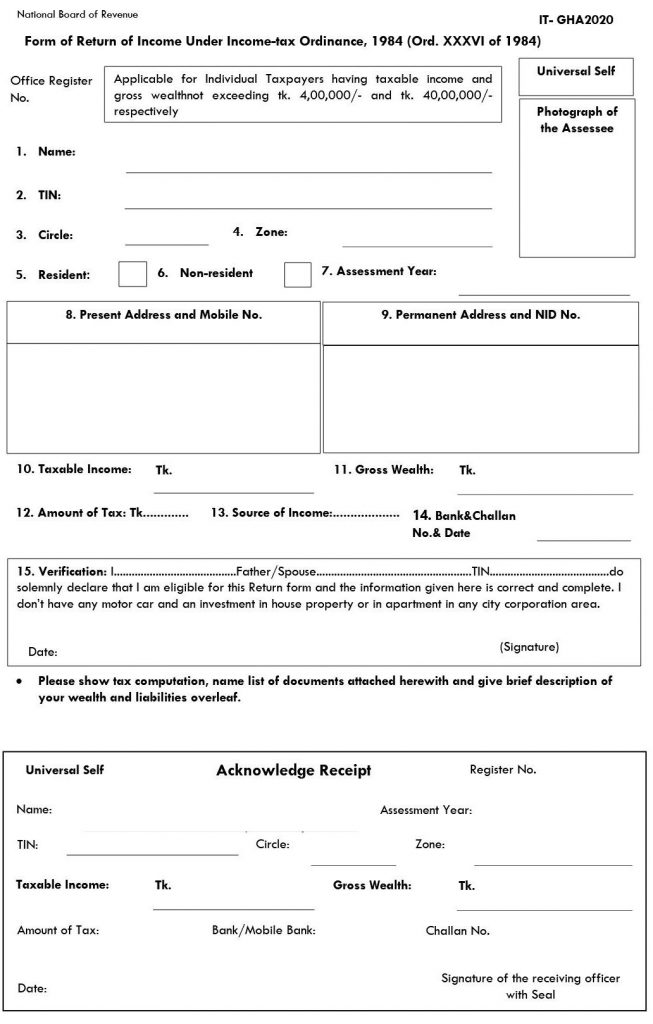

Now we will discuss everything that the form contains one by one and how to fill up that form. First, you will get the form online, especially on the NBR’s website. You have to download that form to fill it up. There are two parts of that form. The first part contains mainly your personal information, and the 2nd one is an acknowledgment receipt.

Read more: Vat Registration Online Application Form

In the first part, there are 15 options that you need to fill up. Before going into details, this form is only for individuals whose taxable income and gross wealth not exceeding tk. 4, 00,000/- and tk. 40, 00,000/- respectively.

How to Fill Up the 1 Page Income Tax Return Form BD?

The options or instructions to fill up the 1 Page Income Tax Return Form BD is described below one by one:

- In the first option, you have to put your name.

- In the second option, you are asked to give your TIN (Tax Identification Number). This unique number is used for tracking all the information about the taxpayer.

- In the 3rd and 4th options, you have to put the circle and zone information respectively you are in.

- The 5th option is for the resident, and if not, then the 6th option is for you. Just select the box you are given.

- In the 7th option, you have to write the assessment year.

- In the 8th option, you have to give your present address with your active phone number, and in the 9th one, you have to give your permanent address and National Identity Card (NID) number.

- Now you have to write your taxable income in the 10th option and gross wealth in the 11th option.

- After then you have to write your payable income tax amount, source of your income in the 12th and 13th options. The bank and challan no. and date in 14th

- The last part is the verification part. Here you need to fill in some information, signature, and date.

Read more: Online Pay Fixation 2024 BD [বেতন নির্ধারণ প্রক্রিয়া]

Income Tax Return Form Download

Now in the 2nd part of the form, you need to fill up some new and exact information. You have to write your name, TIN, circle, zone, taxable income, gross wealth, payable tax, challan no. etc. you also have to write your mobile bank or bank ID there. Again, for the 1st part, you need to submit a passport-size photograph of yours. After all these, your 1 Page Income Tax Return Form BD will be ready for submission.

1 Page Income Tax Return Form PDF 2021-22

Income Tax Return Form Download Bangla PDF

Importance of Filing Income Tax Return Form

We are all aware of the importance of paying income taxes on time. Filling the income tax return is also important. By filling that form government can have an idea about the changes in taxation every year. There are many others facilities also such as your capital losses and gains will automatically be adjusted, and you do not need to do anything for that.

Check also: Pension Calculator in Bangladesh

If you submit your income tax return form, it will be easy for you to claim tax refunds. After the submission of your return form timely, more loans will come to you, and you will receive your tax deductions easily. Buying more assets will be easier for you, and there will be no other tax-related complications. These are some advantages of filing the income tax return form.

আয়কর বিধিমালা ১৯৮৪ সংশোধণের মাধ্যমে ব্যক্তি করদাতার জন্য নতুন রিটার্ণ ফরম (IT-11GA2016) প্রবর্তন করা হয়েছে, যা ২০১৬-১৭ কর বছর থেকে কার্যকর হয়েছে। বিগত বছরের ধারাবাহিকতায় ২০২২-২০২৩ কর বছরেও নতুন রিটার্ণের পাশাপাশি আগের রিটার্ণ ফরমগুলো ব্যবহার করা যাবে। অর্থাৎ ২০২২-২০২৩ কর বছরে ব্যক্তি করদাতাগন নিম্নবর্ণিত আয়কর রিটার্ণ ফরম সমূহ ব্যবহার করতে পারবেন।

১। ফরম IT-11GA2016: সকল ব্যক্তি করদাতার জন্য প্রযোজ্য।

২। ফরম IT-11GHA2020: যে সকল ব্যক্তি করদাতার আয় ও সম্পদ যথাক্রমে ৪ লক্ষ ও ৪০ লক্ষ টাকা উর্ধ্বে নয় এবং যাদের কোন মোটরগাড়ি (জীপ বা মাইক্রোবাসসহ) নেই বা সিটি কর্পোরেশন এলাকায় গৃহ সম্পত্তি বা অ্যাপার্টমেন্ট নেই সে সকল করদাতার জন্য প্রযোজ্য।

৩। ফরম IT-11GA: সকল ব্যক্তি করদাতার জন্য প্রযোজ্য।

৪। ফরম IT-11UMA: কেবল বেতনভোগী করদাতার জন্য প্রযোজ্য।

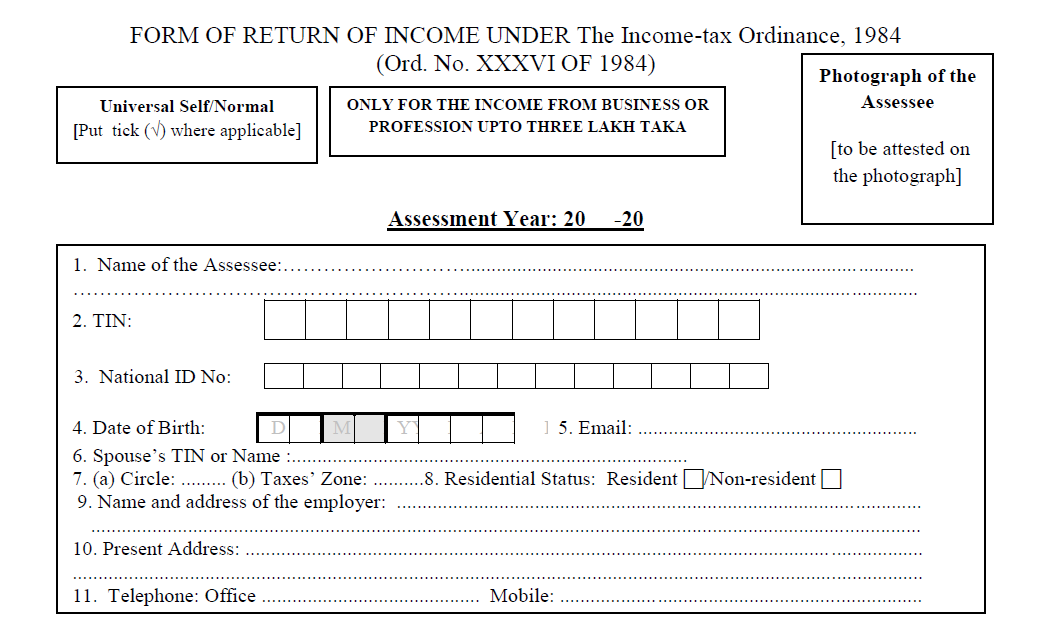

৫। ফরম IT-11CHA: যে সকল ব্যক্তি করদাতার ব্যবসা বা পেশাখাতে আয় রয়েছে এবং এরূপ আয়ের পরিমাণ ৩ লক্ষ টাকার বেশি নয় সে সকল করদাতার জন্য প্রযোজ্য।

- আয়কর রিটার্ন ফরম doc ফরমেট সংগ্রহে রাখতে পারেন Nikosh Font : ডাউনলোড

- বিকল্প হিসাবে Editable PDF Format সংগ্রহ করতে পারেন: ডাউনলোড

Conclusion

We hope that everything is clear to you all about the 1 Page Income Tax Return Form BD. If you need any information about income tax or anything related to income tax, you can visit our website for more. We try to provide accurate information about tax to make this complicated issue more accessible for you. Keep an eye on our website to get your problems solved.