Bangladesh E-TIN Registration Online is a simple process. By registering a TIN certificate, one can validate their income. If an individual does not possess a TIN certificate, the government will declare the money they receive from their source of income to be unlawful, and they will file numerous cases and pay fines. However, in his article you will know about e-tin registration login bd and Income Tax Return 2023-24.

E-TIN Registration Login BD

You don’t need to go to the Income Tax office to get an e-TIN. You can get e-TIN online at home. Moreover, there is no fee to apply for e-TIN. NBR issues e-TIN free of cost. The process of generating an e-tin certificate online is very simple. How to generate a tin certificate online easily by following the below methods you can know:

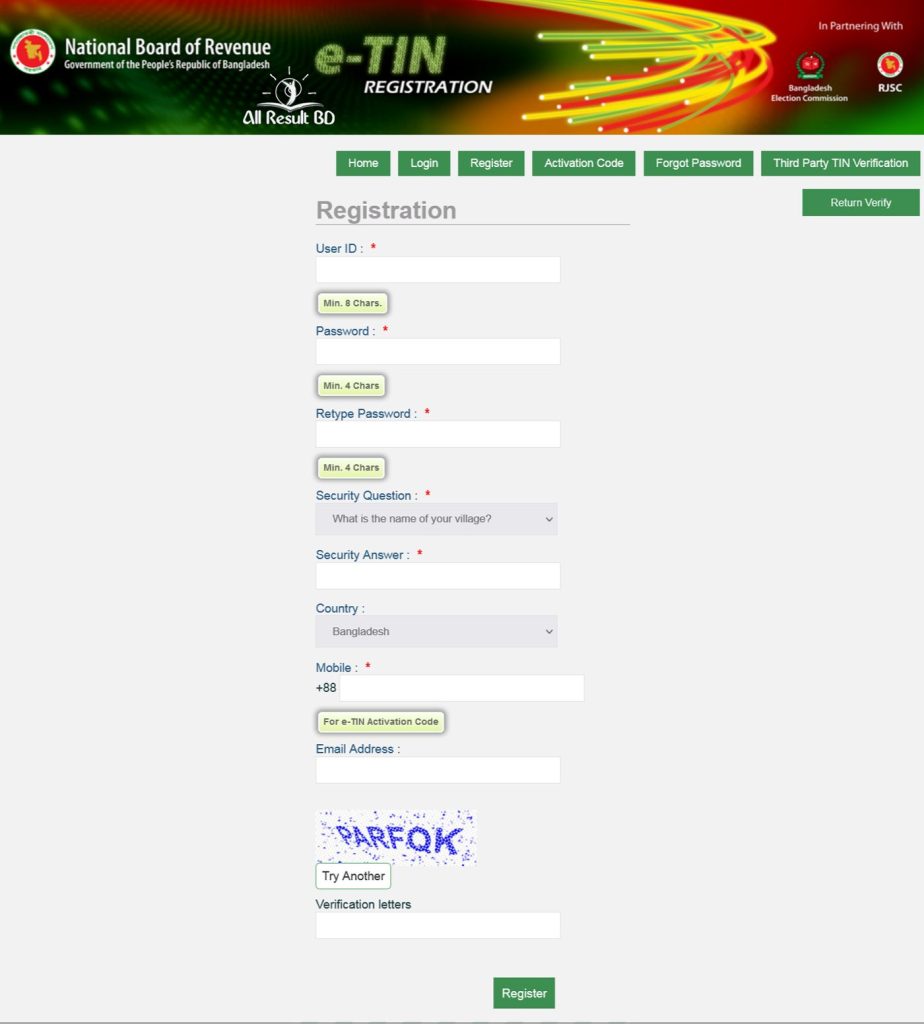

- First, you need to create a user account, and for that you need to login to the official website.

- Clicking on the ‘Register’ button from the homepage of the website will open the online form for TIN certificate registration.

- User account should be created by filling out this online form. Therefore, every part of the form must be filled in English.

- Enter a short name of yourself in the blank field of User ID and enter any password of 8 characters in the field of Password.

- Retype the password in the Retype Password box.

- Any question must be selected in the Security Question box. This is for added security of the ID. Then, answer the Security Question.

- In the field of Country, select the name of the country.

- Then you have to enter an active mobile number in the cell of Mobile.

- Enter your email address in the Email Address field, but this is optional.

- Now, enter the Captcha in the field of Verification Letters correctly. Click on the Register button.

- After clicking the Register button, a code will be sent to the mobile via SMS for mobile verification. Type the code in the e-TIN Activation Code field.

- Then click on the Activate button. As soon as you click on the Activate button, your e-tin registration is complete and a message will appear on the screen asking you to login again.

- Click on the log in option and enter the correct ID and password here during registration.

As soon as you click on the login button, you will be taken to the home screen of your ID.

eTIN Login Process

- Visit the NBR eTIN Website: Access the official website (https://secure.incometax.gov.bd/) of the National Board of Revenue (NBR) in Bangladesh.

- Navigate to the eTIN Section: Look for the section related to eTIN services. This might be prominently displayed on the website.

- Choose ‘eTIN Login’: There should be an option for eTIN login. Click on that option.

- Provide User ID and Password: Enter your User ID and Password. If you don’t have an account, you might need to register first.

- Enter the CAPTCHA Code: Often, there will be a CAPTCHA code for security purposes. Enter the characters displayed.

- Click ‘Login’ or ‘Submit’: After entering the required information, click on the ‘Login’ or ‘Submit’ button.

- Access Your eTIN Dashboard: Upon successful login, you should be directed to your eTIN dashboard where you can manage your tax-related information.

Important Notes:

-

User ID and Password: If you forget your User ID or Password, there is usually an option to recover or reset them through the website.

- Security: Always ensure that you are using a secure and trusted internet connection when accessing your eTIN account to protect your personal information.

-

Contact Support: If you encounter any issues during the login process, you may contact the NBR support or helpline for assistance.

TIN Certificate Download (Create, verify, renew)

How to cancel eTIN Number?

The process for canceling an eTIN (Electronic Taxpayer Identification Number) may vary depending on the country’s tax regulations. Since you haven’t specified a particular country, I’ll provide a general guideline.

- Identify the tax authority or department responsible for issuing and managing eTIN numbers in your country.

- Visit their official website or contact their customer service to find information on canceling or deactivating eTINs.

Income Tax Return 2023-24

Income tax return filing time is November. Tax assessment of your taxable income for the previous financial year (July 2024- June 2024) and filing of tax return by November 2024. In this case your income year is 2023-2024 and tax year is 2023-2024.

However, those who will file income tax return for the first time, they can file income tax return without penalty till 30 June 2024. Still, the time for submission of returns is sometimes extended for the convenience of taxpayers. Always file your income tax returns within the stipulated time to avoid legal hassles.

আয়কর রিটার্ন প্রস্তুতকারী (টিআরপি) সহায়িকা-২০২৩

Income Tax Nirdeshika (2023-2024)

Suppose the income tax return is successfully submitted. In that case, you will see a message where you will see the option to download a Reference ID and Acknowledgment Receipt of the return submission.

What is an eTIN?

An eTIN is an Electronic Tax Identification Number issued by the National Board of Revenue (NBR) in Bangladesh. It is a unique identification number for taxpayers.

Who needs to obtain an eTIN?

Individuals and entities earning taxable income in Bangladesh are required to obtain an eTIN.

How can I apply for an eTIN?

You can apply for an eTIN online through the official website of the NBR. The process typically involves filling out an online application form and providing necessary documents.

What documents are required for eTIN application?

The documents required may include a copy of your national ID card, passport, or birth certificate, as well as other supporting documents related to your income.

Is there an age limit for eTIN application?

No, there is no specific age limit for obtaining an eTIN. Anyone with taxable income can apply.

Can I update my information in the eTIN system?

Yes, you can usually update your information online through the eTIN portal. This might include changes in address, contact details, or other relevant information.

How do I check the status of my eTIN application?

You can check the status of your eTIN application on the official NBR website. There is typically an option to track the status using your application or acknowledgment number.

Is there a fee for obtaining an eTIN?

As of my last update, there might be a nominal fee associated with the eTIN application process. The fee amount can vary, and it’s advisable to check the latest fee structure on the NBR website.

How often do I need to renew my eTIN?

eTINs are typically issued for a lifetime, and there may not be a need for regular renewal. However, it’s crucial to keep your information up-to-date.

Can I apply for an eTIN on behalf of someone else?

Yes, you can apply for an eTIN on behalf of someone else, provided you have the necessary authorization and required documents.

Conclusion

You must register or sign up in the e-return system with your TIN and a registered mobile number in order to submit an e-return online. Every taxpayer in Bangladesh has to file income tax return by 30 November every year.

However, those who will file the return for the first time can file the return by June 30 of the next year without penalty. Income tax returns can be filed online. Individual Income Tax 2023-2024 should be read before filing income tax return.