What do you know about Median Net Worth? Knowing the unknown is a human trait. Nowadays, people have been able to achieve that very easily thanks to the internet. We have brought a topic like Median Net Worth for those curious people. The Federal Reserve Survey of Consumer Finances is the source of all information regarding the median net worth of Americans by age. Every three years, this survey is carried out, and the results are made public the following year.

The survey conducted in 2023 and the data released in 2025 provide the current data. Instead of providing data for specific ages, the Survey of Consumer Finances offers age ranges; we filled in the blanks by linearly extrapolating the data to determine the median net worth at each age.

Just a brief reminder of what net worth is:

In this case of accounting, your assets are everything you own (such as your home, car, bank account (assets held in the account), securities, and rental properties, among others). Here, liabilities are anything you owe to others (such as credit card debt, student loans, any other debt or mortgage debt, etc.).

We obtain a financial measure that we may use to compare across families after subtracting out these discrepancies.

See also: Amouranth Net Worth

The problem with “average” net worth:

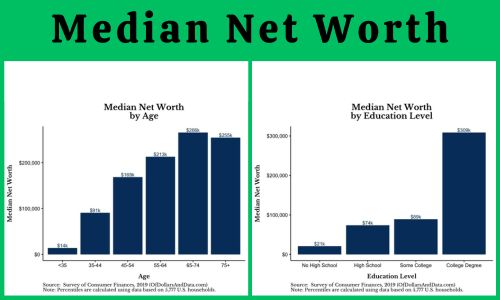

What is the net worth of all US households? $121,511. This is more than 1/6 of the average and net worth. However, this number can even be misleading, as it does not control for life circumstances like age.

In comparison to a retired family with the same amount of money, a 22-year-old with $121,511 is in a significantly different financial situation.

A 22-year-old probably has decades of future earnings in front of him, while a retired couple is living off their accumulated nest egg and may or may not ever work again.

Employment Status

The data from the Survey of Consumer Finances was segmented by employment status by the Federal Reserve, and the findings are fascinating. The median net worth of Americans who are unemployed is the lowest, followed by those who are employed. Americans who work for themselves come in a clear second to retirees.

Educational Attainment

According to the Survey of Consumer Finances, it is well worth the investment. Compared to other educational demographics, Americans with a college degree have a substantially higher median net worth.

Even though going to college can boost your earning potential, we think it’s crucial to make the most of your time in school and make sure your degree is worthwhile. Not everyone needs a college degree to build wealth, and attending one isn’t always the solution.

Median Net Worth of 30 to 39 Years Old

The 1930s are known as the Messy Middle decade because there are a lot of responsibilities and stress levels combined with potential shortages of time and money. Since many Americans in their 30s are either getting their first home or starting a family, building up a sizable net worth may be challenging.

Median Net Worth of Their 40s

People in their 40s have had ample opportunity to witness substantial asset accumulation. On their net worth statement, they might list a home, 401(k), emergency fund, Roth IRA, and other assets.

Late-career Americans in Their 50s

Americans may begin contributing more to their retirement accounts and witness greater gains in their net worth as they approach retirement.

Seniors 60 to 69 Years Old

People in their 60s are probably either close to retirement or have already retired. As expected, their net worth is higher than that of any other age group, according to the data.

Last words:

Hope you got an informative idea about Median Net Worth today with the help of this article. You will like our article. If you like this information then don’t forget to share its link on social media with your friends online, thank you.